How Naftan survives U.S. sanctions

Russia exports oil to Belarus on friendly terms/collage by Ulad Rubanau, Euroradio

About six months have passed since the U.S. sanctions came into effect, and the Belarusian oil refinery Naftan continues to operate. What to make of it? "You don't have to, at the moment," said Aliaksandr Tsishchanka, who was a press secretary of the Belneftekhim conglomerate back then.

To ensure Naftan's functioning, one needs a regular oil supply. Those who provide it will become the object of the "secondary sanctions" courtesy of the White House. Russian and Belarusian governments discovered an easy way out and covered up the supply data.

Euroradio's investigation proved that despite the sanctions, the refinery is getting enough supplies. That said, regardless of numerous talks, Minsk failed to secure the supply from anywhere else but Russia. It means one of two options. One: Belarus stealthily became an oil power and swiftly increased production. Two: Minsk and Moscow hope that the U.S. Department of the Treasury won't figure out the scheme that provides Naftan with a steady flow of oil, which gets sent to the European harbors in the form of sanctioned petrochemicals.

Sanctions are not scaring anyone

Ukraine remains the most significant market for Belarusian petrochemical products. Last year, we sold 45.2% of our petrochemicals there if you count by value or 37.5% if you count by bulk. We got 86% of bitumen sales revenue and 88% of oil gases revenue (statistics lists these two outside of petroleum products) from Ukraine.

The U.S. sanctions do not scare anyone here. The State Statistics Service of Ukraine estimates that Belarus exported almost twice as much as usual (+87.7%) during the eight months of 2021. According to the Ukrainian Consulting Group A-95, some months, Naftan was supplying the Ukrainian market with even more products than before the American sanctions.

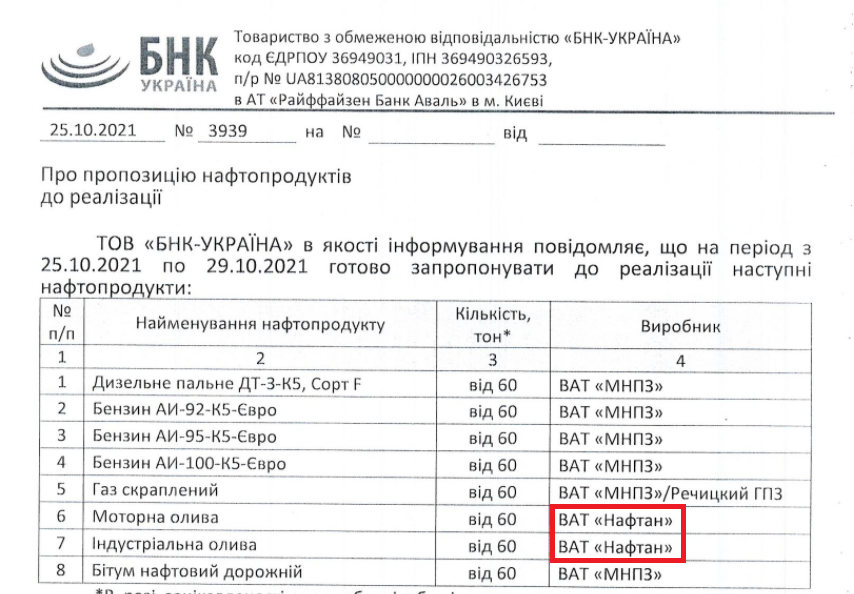

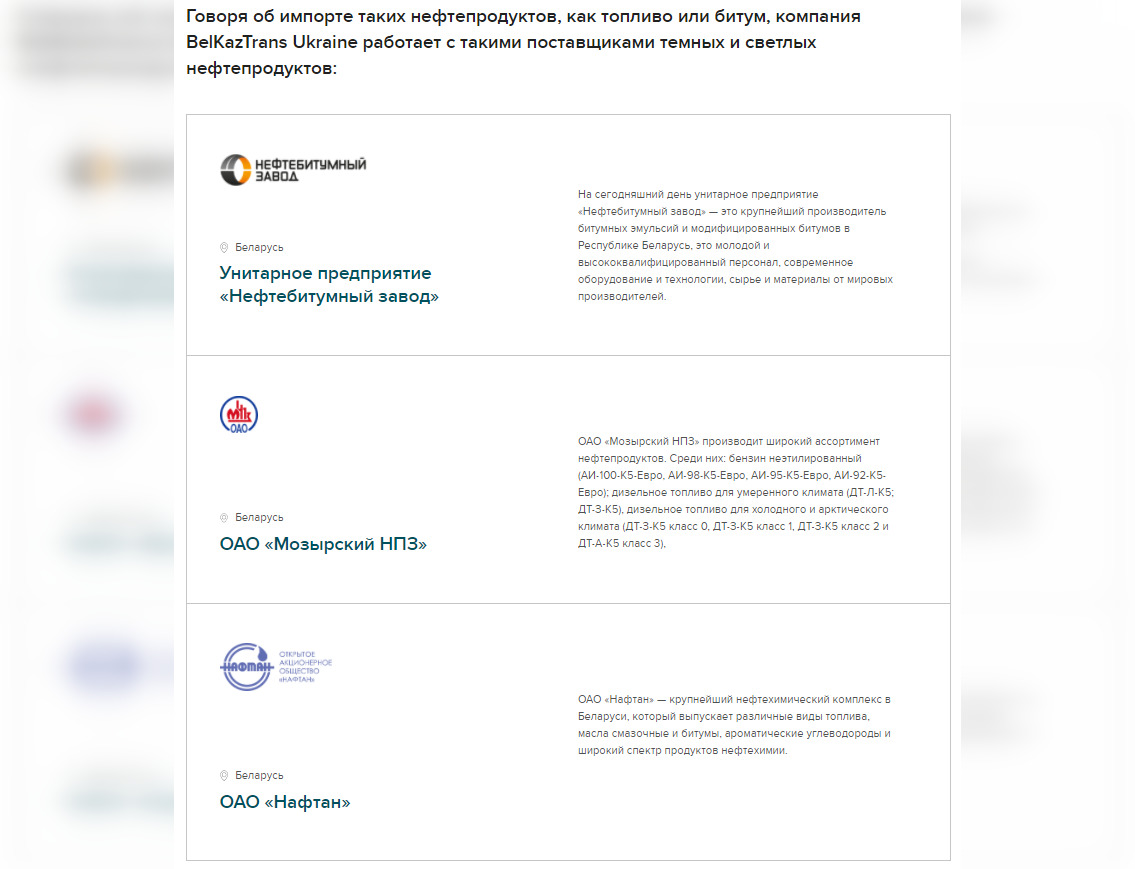

Special state export agents, like BNK-Ukraine (a subsidiary of the Belarusian Oil Company) and New Oil Company, handle petroleum products trade between Belarus and Ukraine. Several times a month, a list of products sold is updated on the BNK-Ukraine website. Never once has Naftan lost its spot on the list since the American sanctions kicked into action again.

Via Russia to the EU

During the seven months of 2021, Belarusian Railway shipped to Russia five times more petroleum products than during the January – July period in 2020. Just a fraction of these 1.2 million tonnes of fuel got to the Russian gas stations. Everything else went to the top-grade European market.

It is economically advantageous for Belarus to trade with Europe, where fuel costs more than in Russia. An employee of Naftan, who Euroradio managed to contact through the National Anti-Crisis Management, encountered that at least back in June, Naftan's petroleum products were making it through the Ust-Luga and Saint-Petersburg seaports to the Netherlands. Some part of the produce went through the Estonian Liwathon E.O.S. terminal to be sent to Malta afterward.

"New Oil Company is the cargo owner," added our source.

The Netherlands and Malta are the transit hubs that offload petroleum products to the rest of the world. Most of the Belarusian export to these countries is classified information – we can see the total but not the specific items sold.

Say, during the eight months of 2021, compared to 2020, our export to the Netherlands has doubled and totaled $1.49 bln. But only $180 million of that is on open access. Malta, with the total sum of $20.8 million in Belarusian export for the same period and only 0.16% on open access, paints a similar picture.

Classified trade positions usually include tobacco (since the middle of the 2010s), weapons, and precious metals. The 2021 list also includes potassium fertilizers and everything related to the power industry. Last year, potassium chloride's share was minuscule in the total exports to the Netherlands, while petrochemicals constituted 53%.

The last ten years of our exports to Malta looks like that:

In the peak years of 2013 and 2018, the goods exported were 100% "other distillates and products," meaning petrochemicals.

Who's that exporter?

The owner of the New Oil Company's 75% of shares is Mikalaj Varabei, often labeled as "Lukashenka's moneybag" in the press. When the firm was established in 2020, nobody tried to hide that it would market Naftan's products.

Both the New Oil Company and BelKazTrans Ukraine are on the U.S. Department of the Treasury sanctions list. Everyone with business related to the blacklisted company risks "secondary sanctions." The U.S. promises to block dollar transactions for them. Such a punishment would hamper the work of any company that gets its money from cross-border trade. The Ukrainian market players are not stopping the business unless the sanctions are hanging over their heads.

"Market works"

Belarus increased exports to the countries that mainly received petroleum products in the past. This increase could have affected supply on the domestic market, but there's no shortage of fuel in Belarus.

Hence, the biggest Belarusian oil refineries (there are two: in Navapolatsk (Naftan) and the other in Mazyr) have no shortage of natural products. The amount of supplies they're getting allows them to offload fuel to the Belarusian gas stations and European seaports. It means that despite the threat of sanctions, Russian companies have not stopped exporting oil to Belarus.

This September, we tried to ask Aliaksandr Tsishchanka, Belneftekhim's press secretary, about that.

Euroradio: Export of petroleum products to Ukraine is growing. How is it happening?

Aliaksandr Tsishchanka: That's how the market works.

Euroradio: I understand it could be working this way. But what does it mean?

A.T.: I'm not going to tell you anything about that yet. It is simply how the market works.

Euroradio: Transneft claims that Naftan did not submit a request for Russian oil supplies in the third quarter. Naftan keeps exporting to Ukraine, though. Where does Naftan get the raw product, then?

А. Т.: Market works.

Euroradio: What market?

А. Т.: The world market.

Euroradio: It doesn't make sense at all.

А. Т.: It doesn't have to, just yet.

Euroradio: When can we call you again and ask to elaborate on the matter?

А. Т.: Hard to say when it's possible to elaborate.

Despite all the attempts, Minsk didn't secure a sizeable oil supply from Kazakhstan, Venezuela, or the USA. In February 2020, Mike Pompeo, the U.S. secretary of state, promised Aliaksandr Lukashenka to "deliver 100% of the oil you need". Even that didn't work out in the end.

The one country we started a significant business relationship with was Azerbaijan. In 2021, it exported $235.2 million worth of goods to Belarus, of which only $7.7 million are on open access. So, Azerbaijan sold Belarus around 400,000 tonnes of oil. Even if it all went to Naftan, the refinery would not have enough product to last a month with an optimum workload or something close to it.

Oil power

Could it be, perhaps, that Belarus stealthily and swiftly increased domestic crude production and became an oil power? Hardly. Recently, Aliaksandr Lukashenka again commanded to find "a sea of oil or something" in Belarus. They're still looking for it.

Every year, Belarus pulls 1.6-1.7 million tons of crude oil. The volume remained more or less steady through the last five years. Belarus sells all of this oil to Germany, except for the previous year, when Belarus left 500,000 tons for itself, possibly due to the Russian oil supply disruptions at the start of 2020.

Judging by the January – August 2021 data, Belarus keeps on selling its oil to Germany. Belarusian oil refineries are not getting it. There is no need, perhaps, since they have other supply sources.

Humpty Dumpty sat on a pipeline

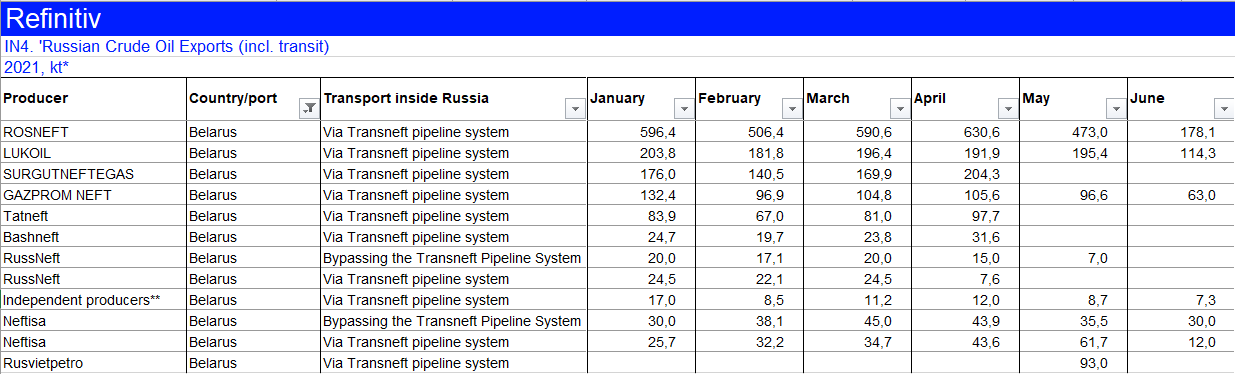

According to Refinitiv, before the sanctions, 95% of Russian oil was flowing to Belarus through the pipeline – the Transneft controlled Druzhba pipeline. Other 5% was brought in by railway. If Russian companies were afraid of sanctions, Naftan wouldn't have gotten any supplies.

At first, they pretended to care about the sanctions. Transneft press secretary Igor Demin stated that the company hasn't been supplying Naftan with raw produce in the second half of 2021 and will not be doing it further on. But then, Siarhei Yautushyk, Naftan's chief ideologue, babbled out about a third-quarter incoming oil supply of 2 million tonnes from Transneft. And Demin called him down sharply, saying he was "surprised" to hear such claims.

The only thing Demin could be surprised by was the chattiness of Naftan employees. Yautushyk wasn't the only one to mention there was no shortage of supplies for the refinery. "Our main duties stay the same. It's taking the raw materials delivered by pipeline or railway. Every month, we receive more than 700,000 tonnes of produce and offload more than 20,000 tonnes a day," revealed Yauheni Rybnikau, Naftan's automation engineer, to the trade paper Vestnik Naftana (issue 28, July 17). Euroradio's source agrees that the refinery's workload was about that size at the end of June.

Not too much classified: Russian oil shipments grow

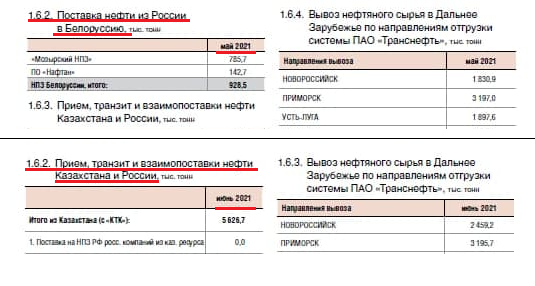

The Belarusian National Statistic Committee and Transneft are not the only ones who have hid oil industry data. Eurasian Economic Commission and the Central Dispatching Department of Fuel Energy Complex (CDU TEK) of the Russian Ministry of Energy has done it, too. The latter excluded the "oil supply from Russia to Belarus" category from its publications altogether.

Euroradio managed to calculate the approximate total of Russian oil supplies to Belarus. This research is based on the information from 2020 and existing incomplete data from 2021.

In 2020, classified Russian export to Belarus constituted only 2.2%. In other words, almost everything was in the public domain. This year, gas, oil, electrical energy, and potassium fertilizer categories became hidden. Belarus does not buy potassium chloride, though, and barely imports any electricity from Russia.

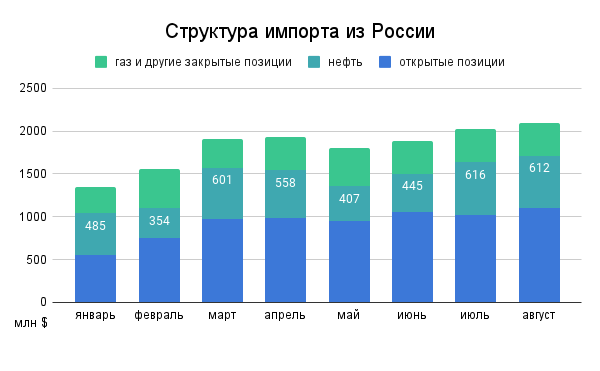

A more comprehensive analysis of the 2021 import is possible until June 2021, thanks to the existing oil supplies data in the EEC statistics. For example, Belarus spent $1.352 bln on Russian goods in January 2021. $556 million worth of goods are on open access, another $486 million is an oil bill.

The remaining $310 million were spent on other goods, already hidden in January. Judging by the last year's import structure, this is mostly gas and other classified products. We had $310–$450 million worth of hidden products like that monthly during the January- May period.

After May 2021, the EEC's data on oil bills ceases to exist. On the bright side, if we subtract open access categories and these $310–$450 million from the import total, we get a number consistent with the amount of money we used to spend on oil. Some months, this number is even higher than it was before the sanctions.

In May, Belarus bought 0.92 million tonnes of oil from Russia, and after that was consistently buying more than 1 million tonnes monthly. By July, the Urals oil value, the one that the Belarusian oil refineries use, grew by 9%. In July, our oil expenditure has tripled.

The cruising power of a Mazyr oil refinery without sanctions is 1 million tonnes a month. But seeing as the refinery was closed for some time in the summer because of the renovations, it turns out that during the June – August period Belarus was buying oil in Russia with Naftan in mind.

Old friends' schemes

Before 2021, the biggest oil suppliers for Naftan used to be Rosneft, Surgutneftegaz, Tatneft, Bashneft, and Russneft. According to Refinitiv, all of them stopped selling to Belarus in May, except for Rosneft. The latter resumed trading because, legally, it was supplying the Mazyr oil refinery.

In May, when the sanctions were announced but didn't come into effect yet, Euroradio sent official inquiries to every Russian company that sold oil to Belarus. Surgutneftegaz was the only one who responded:

"Naftan is a long-term client of ours. We have no comment on everything else that's happening right now [the USA sanctions. – Euroradio]."

After our investigation, it became clear that the Russian oil supply to Belarus and, specifically, Naftan never stopped. Oil and gas market experts are inclined to believe that Navapolatsk refinery uses quasi-legal schemes for oil supply. The Belarusian company is likely cooperating with Russian front companies that are not afraid of the sanctions.

A Navapolatsk refinery employee who we managed to get in contact with through the National Anti-Crisis Management just the day before the publication confirmed this to Euroradio:

"Oil's coming to the refinery from Russia by the pipeline with the help of front companies. In Russia, just before the border, the pipeline bifurcates for Mazyr and Navapolatsk. So, Transneft is surely aware. It is difficult to provide more details right now because the front companies were changed. Naftan supplies domestic market and offloads a little bit to Ukraine," he told us.

We sent another round of inquiries to all of the oil companies that supply Naftan and Mazyr refineries but have not received any responses