Excise duties on fuel, alcohol, cigarettes key for Belarus budget

Vadzim Zamirouski, finance.tut.by

In 2019, the Belarusian budget stands to receive 2.4 billion BYN from the excise duties charged by the state on fuel, alcohol and cigarettes, as well as the payment for excise stamps. This follows from the unpublished part of the budget received by Euroradio.

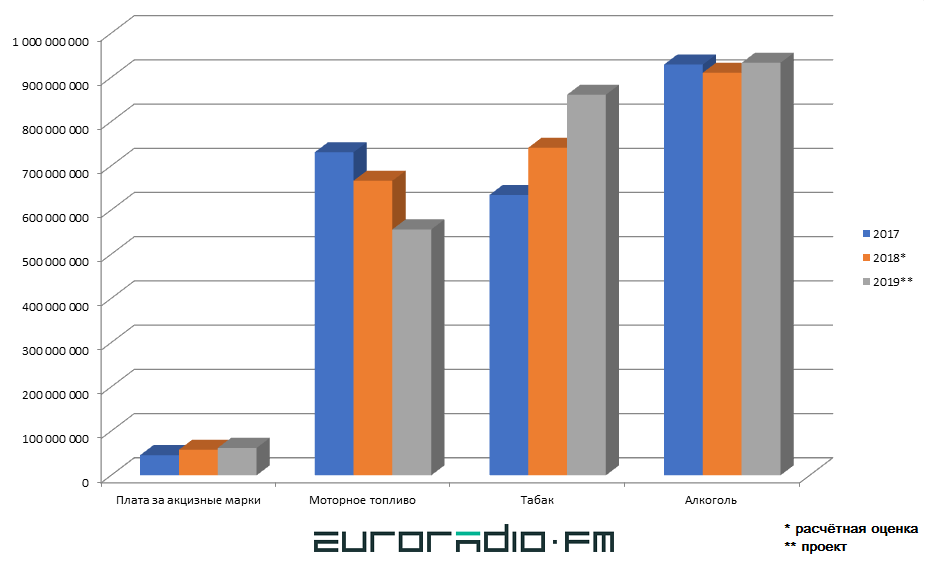

Excise revenues on alcohol in the draft for 2019 should amount to 933.1 million BYN, fuel - 556.2 million BYN, tobacco - 860.8 million BYN. Another 62 million BYN should come from the payment for excise stamps.

We compared excise tax revenues from 2017 to those of 2019:

As can be seen from the graph, the revenues from excise duties on alcohol are stable, they remain at the level of RUB 900 million. The same can be said about revenues from excise duty stamps. However, the situation with excise duties on tobacco and fuel is different. The first is growing every year, while others are falling. What causes it?

The Belarusian budget loses money linked to motor fuel excise duties due to the suspended supplies of Russian oil products to Belarus. In 2017, revenues from excise duties on imported motor fuel from Russia amounted to 169.3 million. However, the entire 2018 the supplies were going down until December when Russia imposed restrictions due to its budget losses over possible re-export of petroleum products from the territory of Belarus. As a result, only 93.4 million BYN was received under this item in 2018 (according to estimates).

The draft budget for 2019 does not provide for excise duties on Russian fuel at all. Hence the further decline in revenues under this item.

As for tobacco, in November 2018, the EEU countries agreed to introduce an indicative excise tax on tobacco products. It is planned that starting from 2024, a single excise tax of 35 euros per 1,000 cigarettes will be introduced in the EEU. At the time of signing the agreement in Belarus, excise duties on tobacco products were much lower. Our country is "catching up" -- excise taxes are growing, as well as the revenues of the Belarusian budget.

In case of tobacco, it can be seen how much money goes to the budget from cigarette producers in the form of taxes. According to the Ministry of Taxes and Levies, two Belarusian manufacturers, GTF Neman and Tabak-Invest, paid taxes of 903.4 million BYN in 2017, while in 2018 this figure rose to 1.23 billion BYN, while in the first 6 months of 2019 alone, 722.1 million BYN have already been paid.